Strategy and Prospects

Sustentability

Inovation

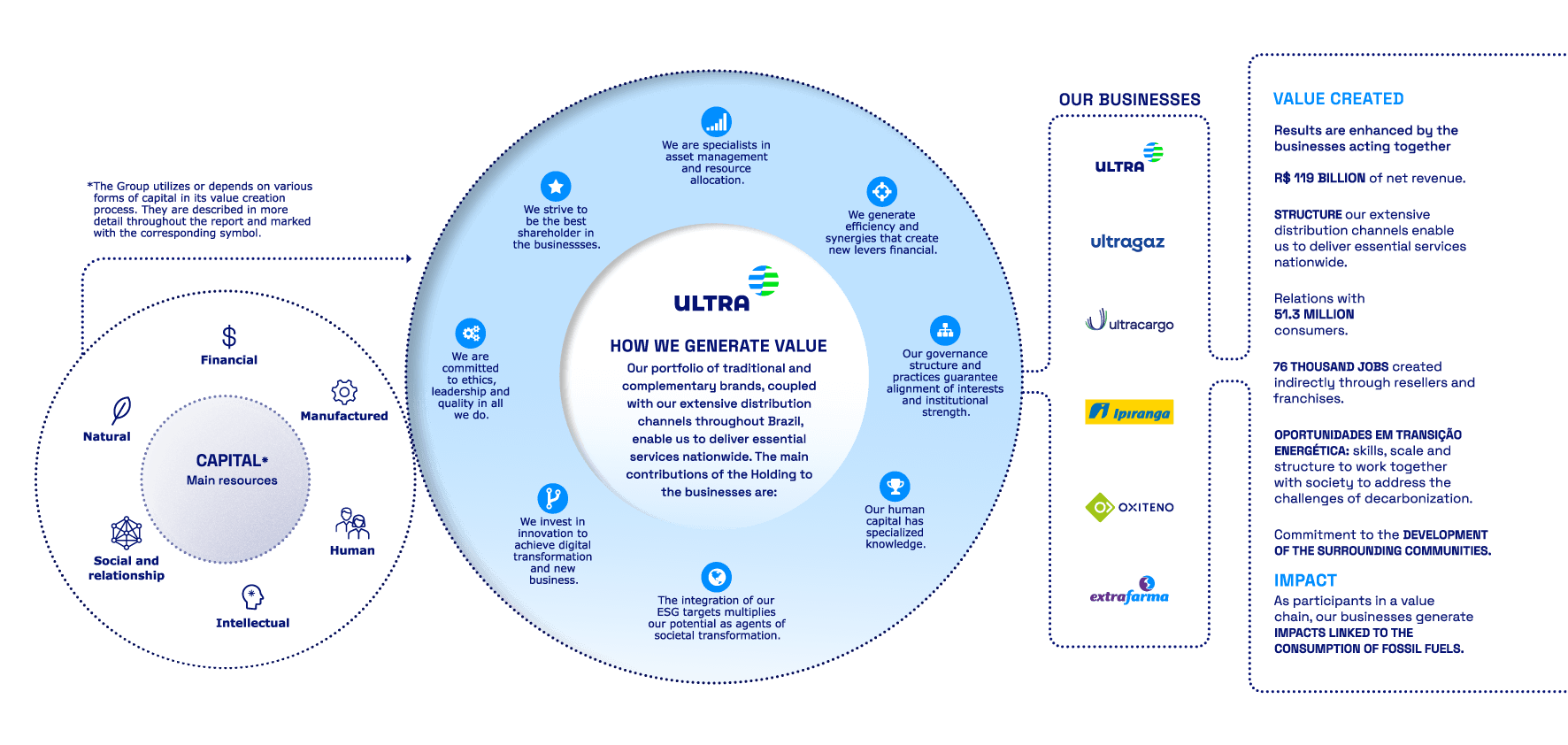

Business model

Strategy and resource allocation | Prospects | Business model

Strategy and resource allocation | Prospects | Business modelIntellectual capital

The Ultra Group undertook a strategic review of its business portfolio in 2021 seeking to achieve a greater degree of agility, complementarity and synergy among its main businesses, thereby reinforcing its strong market positions in the Brazilian energy and infrastructure value chains.

In addition to proceeding with its investment plans and the expansion of its existing businesses, the Group is constantly looking for opportunities to increase the scale of its operations and also to respond to the challenges of decarbonizing the economy.

The divestment of Oxiteno, Extrafarma and ConectCar (see the table below) were a direct result of this change in focus and will also contribute to strengthening the Group’s cash position and investment capacity.

Furthermore, in 2021, the Group terminated ts negotiations with Petrobrás for the acquisition of the Alberto Pasqualini (Refap) oil refinery, located in Canoas (RS), due to certain critical conditions not being met.

- ULTRA GROUP’S STRATEGIC OBJECTIVES

Profitability in core business activities, leveraged by proximity to the customer, operational efficiency, digital intelligence and development of economies of scale

Main business activities are concentrated in the energy and infrastructure value chains, with an increasing focus on energy transition

Leveraging of digital initiatives

Portfolio Rationalization (2021)

May

Extrafarma

![]()

Pague Menos

Amount

R$ 700 million

June

ConectCar

![]()

Porto Seguro

Amount

R$ 165 million

August

Oxiteno

![]()

Indorama Ventures

Amount

US$ 1.3 billion

Payment of US$ 1.15 billion at the closing of the transaction and US$ 150 million in two years.

Business Strategy

Ultragaz

Ultragaz continued to intensify its actions focused on innovation and increased proximity to its customers in the business, household and reseller segments. In 2021, it renewed its brand image and summarized its strategy in the phrase Somando Energias (Combining Energies), which represents its purpose of improving people’s lives by using its experience and capacity to innovate in creating energy solutions for individuals and businesses. It seeks to achieve this purpose through annual launches of solutions in the customer segments for industry, commerce and services, agribusiness, and condominiums and households. One of the highlights in 2021 was the launch of the agribusiness solution called Ultragaz Secagem de Grãos – Arroz (Ultragaz Grain Drying – Rice), which, by using temperature and humidity sensors, controls the grain drying process, thereby optimizing energy consumption and reducing costs for the farmer.

In addition, it continues its pathway to increasingly digitize its solutions, enabling the evolution of its relationship strategies with customers in the business, household and reseller network segments. At the end of 2021, the Ultragaz app, launched the previous year, had recorded over 1.7 million downloads. With regard to its infrastructure, the start-up of bottling operations in Miramar (PA) and storage and distribution in Mucuripe (CE), in the first quarter of 2022, will allow Ultragaz to participate in the expected expansion of the LPG markets in the North and Northeast regions of Brazil.

Ultracargo

The investments in capacity increases and productivity gains in Ultracargo resulted in increased efficiency and value generation for customers, and contributed to the record revenues recorded in the last quarter of 2021. The company continued with its objective of expanding its activities in strategic port terminals, especially in the North and Northeast regions, and of increasing the size of its port operations to capture opportunities in the bulk liquids handling sector. In 2021, it accelerated the completion of the expansion project in the Itaqui port terminal (MA), which added 46 thousand m³ of capacity, and it made a successful bid in an auction for a concession in an additional area in the same port for the construction of a new terminal, which will be connected to the existing one and will add a static capacity of 79 thousand m³. The start of operations at the new terminal in the port of Vila do Conde (PA) was also brought forward by one year. It has a capacity of 110 thousand m³, and marked Ultracargo’s market entry in the North region of Brazil. The other priorities of the company are the continuous improvement of its operations, based on the lean production and six sigma concepts, and the digital transformation of its business activities.

Ipiranga

Ipiranga is committed to the continuous evolution of the value proposition of the complete service station, and one of its priorities is to leverage operational and logistical efficiency. In 2021, the company’s focused on restructuring the Transport, Planning and Logistics Execution areas and reviewing two of its main processes: advanced model of sales and operations planning (S&OP) integrated to its strategy, and order to cash. Another strategic pillar is pricing. The company has already achieved an improvement in margins after establishing an area dedicated to Pricing Intelligence.

To increase the quality of its network, and the services provided to consumers, the company has carried out a number of initiatives including establishing an exclusive relationship strategy for large resellers. Ipiranga also aims to selectively expand its network, in line with its plans to increase efficiency. In 2021, Ipiranga closed down 340 service stations and opened 337, so at year-end the network consisted of 7,104 units, only three less than at the previous year-end. Using an approach that it calls “engagement through enchantment” the company is committed to strengthening the value of its brand in the eyes of its main stakeholders (employees, resellers, business customers and end consumers). In 2021, the Ipiranga brand was elected the 13th most valuable brand in Brazil in the ranking published by the Interbrand consultancy.

The strategic pillars of the AmPm business are aimed at strengthening the value proposal for franchisees, consolidating company-owned stores, improving the quality of the services offered through a differentiated consumer experience and exclusive own-brand products, and operational excellence. The plan to gradually expand the network will focus on quality and increasing the number of stores near the distribution centers. In 2021, AmPm made good progress in refurbishing its stores and in incorporating its digital package, which together improve the consumer’s experience and strengthen the brand’s presence in a variety of channels. The company also accelerated the program of opening company-owned stores, enabling it to continually develop the package of solutions offered to franchisees. By December, the company had implemented the new AmPm store concept in 162 stores, incorporated the digital package in 450 stores, and increased the number of company-owned stores to 206.

KMV/abastece aí

The E-aí Clube de Automobilistas (E-aí Motorists’ Club) is a digital platform that combines the KM de Vantagens loyalty program and the abastece aí digital payments app. The platform upgraded and strengthened its technology in 2021, and ended the year with 2.8 million active accounts in the digital wallet and 36 million registered customers in the loyalty program. The platform has been run independently of Ipiranga since 2020 and its operational strategy is to continually improve the user experience when filling-up with fuel, increase the partner base and invest in the ongoing development of new products and services that are important to the motorist and the surrounding mobility eco-system.

Public policies and the regulatory environment

The Ultra Group has an Institutional and Governmental Relations area that reports to the Corporate Development and Advocacy Executive Directorate. The area monitors regulatory issues and public policies to identify those that could impact the strategy, prospects and results of the Group or the individual companies in the portfolio.

The area’s work includes relations with many different stakeholder groups (government authorities, representative associations, the media and opinion makers, academia and organized civil society) and these interactions are carried out in accordance with the best practices in ethics and integrity, such as the formal registration of meetings in a dedicated system, and with the support of the compliance team.

Some of the most important themes currently monitored by the team are as follows: tax simplification; combating the irregular marketing of fuels; infrastructure; energy transition; and bio-fuels. read more information on these latter two topics

The simplification of taxes in the sector, which is supported by the Group, would have positive effects on the efforts to combat irregularities in the fuel market, such as: tax evasion; adulteration of fuels; and volumetric fraud (tampering with the pump and the amount of fuel supplied). These irregularities cause damage to all the participants in the fuel distribution value chain. The government receives less tax, regulated resellers and distributors lose revenue and consumers purchase lower quality or less fuel.

Sustainability

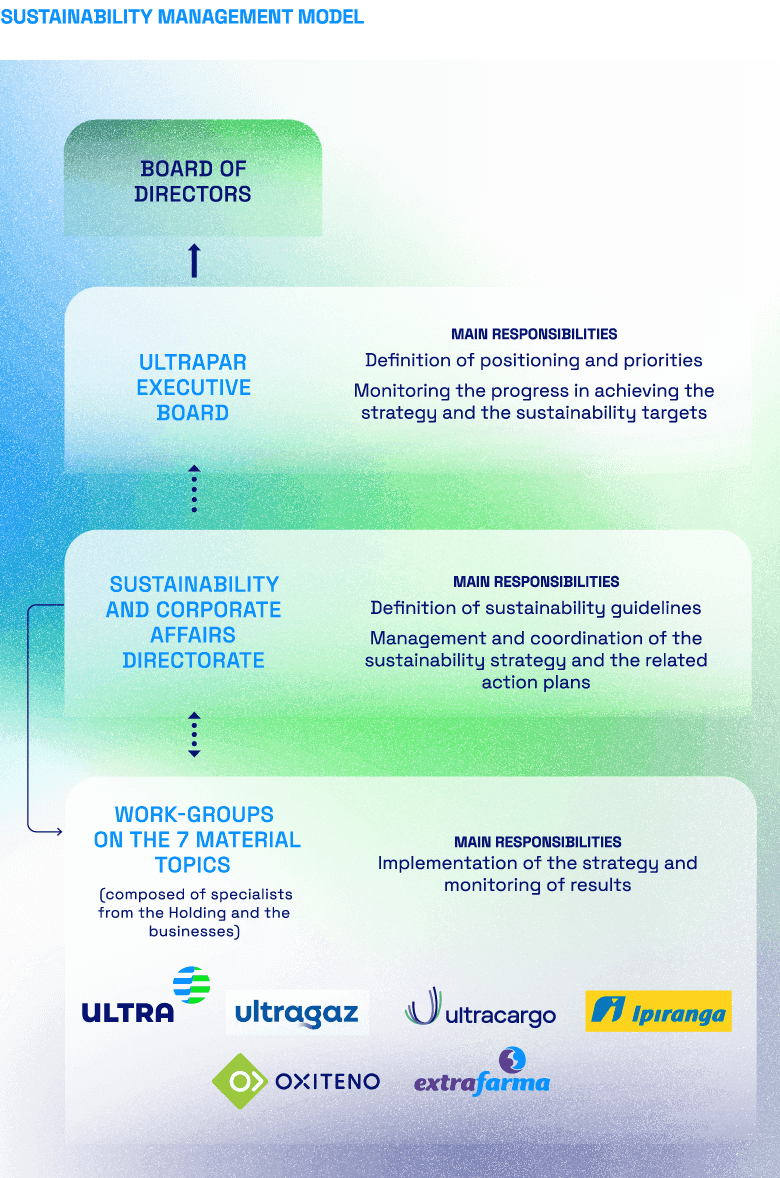

The Ultra Group made substantial progress in implementing its sustainability agenda in 2021 with the strengthening of the management structure, definition of the strategic guidelines and discussions on the material topics in the various internal forums.

At the beginning of 2021, the Group created the Sustainability and Corporate Affairs Department in order to reinforce the management of the challenges related to the environmental, social and governance agenda. The department reports to the recently created Corporate Development and Advocacy Executive Directorate. It should be noted that the businesses also have structures dedicated to sustainability, which address the characteristics and specific challenges of each company.

Multidisciplinary work-groups were set up, one for each material topic. In total they held more than 100 meetings throughout the year, with the involvement of approximately 250 people from the Holding and the businesses. Under the coordination of the Sustainability Directorate, the discussions in the work-groups deepened the organization’s understanding of the impacts and opportunities related to each material topic and enabled them to define the organization’s future ambitions.

Topics related to ESG issues were also included in the agendas of the monthly meetings of the Ultrapar Executive Board and the business advisory boards, as well as in those for the meetings of the Board of Directors and its advisory committees.

This broad movement of discussing, listening and learning by all parties was essential for the construction of a common vision, called the sustainability macro-strategy, which has now been incorporated in a structured way into the Group’s overall strategy. This process culminated in the definition of the Ultra Group’s sustainability commitments, and its targets for 2030. These commitments and targets were approved by the Ultrapar Executive Board and by the Board of Directors.

In 2022, the work-groups will continue to meet in order to monitor the execution of the action plan for each material topic in order to enable the Group to achieve its long-term sustainability commitments.

Towards the end of 2021, the Ultra Group became a signatory of the United Nations Global Compact (UNGP). The Group’s adherence to the UNGP reinforced the commitments of the Holding and each of its businesses to the defense of human rights, labor rights, the environment and anti-corruption practices.

Presence in ratings and ESG indexes

The Ultra Group has been included in a number of indices that assess and rank organizations according to their performance in environmental, social and governance criteria. The Group has been included in the following ratings and indexes:

- MSCI ESG (Morgan Stanley Capital International): the index assesses an organization’s exposures to ESG risks and the quality of its risk management processes. The classification is as follows: leader (grades AAA and AA); average (grades A, BBB and BB); and laggard (grades B and CCC). In October 2021, the Group was rated A.

- FTSE4Good: a series of indices that measure the performance of organizations in ESG practices. Scores range from 0 to 5 for each factor (environmental, social and governance). In June 2021, the Group obtained an average score of 3.0. It currently is included in two indices: FTSE4Good Emerging Index and FTSE4Good Emerging Latin America Index.

- ICDPR70 (CDP Brazil Climate Resilience Index): The Group has been included in the portfolio until March 31, 2022. Its inclusion was due to its performance in the Carbon Disclosure Project (CDP) 2020 Climate Change Questionnaire, in which it obtained a B score.

- ICO2 (Carbon Efficient Index): The Group has been included in the B3’s portfolio since 2012.

- IGC (Differentiated Corporate Governance Index) and ITAG (Differentiated Tag Along Index): The Group has been included in these B3 portfolios since 2011.

Sustainability pathway: evolving together

Over the last three years, the Ultra Group has strengthened its sustainability structure and increased its knowledge about its material topics and their impacts.

2019

- Ultra Group carried out its first materiality study, covering all its businesses

2020

- Creation of work-groups for each material topic

- Ultracargo, Ipiranga and Extrafarma completed their first materiality matrix processes

- Ipiranga launched its new sustainability strategy

- Ultragaz launched a new Strategic Sustainability Plan

- Oxiteno consolidated its Strategic Sustainability Plan, and established ESG targets for 2030

2021

- Creation of the Sustainability and Corporate Affairs Directorate reporting to the recently established Corporate Development and Advocacy Executive Directorate

- The Ultra Group’s material topics were updated

- The work-groups deepened the Group’s understanding of each material topic and worked on defining targets

- Ultragaz launched an initiative called Jornada ESG – Ultragaz mais sustentável (ESG Journey – a more Sustainable Ultragaz), with an ESG positioning based on activity in four dimensions of energy, namely: Human, Innovation, Citizenship and Ethical.

- Ultracargo launched a new Strategic Sustainability Plan

- Ipiranga established the theme sustainability as one of its strategic initiatives, supported by a structure, investment and monitoring by senior management, and launched an action plan to embed a culture of sustainability.

2022

- Definition of the Ultra Group’s public commitments, with a focus on 2030

- Sustainability targets were included in the performance evaluations for the variable remuneration of the Group’s entire senior management team

Sustainability is a journey of continuous evolution. The good progress made by the Group so far was due to the pro-active participation of all its businesses.

The consequences of the Covid-19 pandemic, the resolutions of the 26th United Nations Conference of the Parts on Climate Change (COP 26) and the demands by society in general have increased the importance and visibility of the themes of governance and integrity, energy transition, responsibility for the surrounding communities and health and safety. To better respond to this scenario, the Group is reviewing its targets for these themes.

Innovation

The capacity and ability to innovate are essential to ensuring the long-term continuity of the Ultra Group. The Group established an Innovation Committee in 2019. This forum seeks to foster a culture of innovation and promotes the sharing of experiences between the Holding, UVC Investimentos and the businesses. In 2021, the committee met five times. The Group also has a number of work-groups dedicated to innovation topics, which are organized on an ad hoc basis throughout the year for in-depth discussions on the most relevant topics.

In line with the Group’s management model, the businesses also have the autonomy to establish their own innovation and research and development structures.

The search for new ideas has expanded in the Group following the creation of UVC Investimentos (UVC) in 2020. It is a venture capital fund with R$ 150 million to be invested until 2029. Its mission is to generate a profitable return on capital by investing in start-ups that operate in areas relevant to the Ultra Group’s main areas of activity or that are, or could be, disruptive to its businesses.

The fund’s operating strategy made progress in 2021. It prioritized its prospecting for start-ups in four areas: sustainability (environmental), clean energy, urban mobility and new retail trends, all aiming to originate new avenues of growth for the Group. Since the fund was established, R$ 56 million has been committed to direct investments in six start-ups and in indirect. investments in a portfolio of start-ups via two other venture capital funds.

In addition to generating a profitable return on capital, UVC seeks to expand the Group’s participation in the innovation ecosystem, strengthen the relations with start-ups and, together with the Holding’s Innovation Committee, to leverage the stimulation of a culture of innovation and the identification of strategic synergies between the businesses. In 2021, the UVC team held more than 200 meetings with start-ups and other players in the innovation ecosystem (venture capital funds, corporate venture capital initiatives and innovation hubs, among others). The UVC team also participated in monthly meetings with the Ultra Group’s internal innovation teams.

abastece aí: leveraging the relations between customers and resellers

The abastece aí platform, which originated as a fuel supply discount program within Ipiranga’s relationship program (Km de Vantagens – KMV), has now evolved and is focused on the motorist. It has expanded the benefits and range of services it offers to consumers, through an easy-to-use and flexible format for digital payments combined with rewards in the form of cash-back. The cash-back rewards can be used for purchases at partner institutions, the direct payment of bills and cash transfers via the PIX payments system to other individuals. In this way, the platform generates savings for users and more business for an expanding partner base.

In 2022, the platform will focus on consolidating its positioning in the motorist segment, improving the user experience for both KMV and abastece aí customers.

abastece aí originated as a digital service, and it continues to evolve, using an agile methodology approach, to continually improve the user experience. As a result, abastece aí is also contributing to promoting the dissemination of the skills of the new frontiers in innovation in both the Holding and the businesses. abastece aí has a team of 138 employees, composed mainly of specialists in programming, design, marketing, mobile data development and data intelligence, among others.

abastece aí also generates repeat sales and customer loyalty for the Ipiranga service stations, representing a competitive differential in customer retention and value generation.

Innovation Committee Results

· 298 initiatives cataloged (56 in 2021)

· 5 cross-cutting initiatives (presented by one of the businesses on the committee and which attracted the interest of other Group businesses)

Innovation Event 2021

· > 700 participants

· > 6 hours of presentations

· 8 external speakers

UVC Investimentos

· R$ 150 million or investment in start-ups by 2029

· R$ 56 million already committed

For more information, access the link:

www.uvcinvestimentos.com.br

abastece aí

2,8 million

active accounts

40

partners from various segments

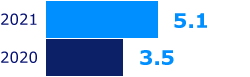

Value transacted (R$ billion)

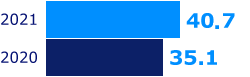

Transactions (millions)

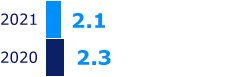

New Accounts (millions)

Business Model