Financial Performance

Prospects | Performance

Prospects | Performance Financial capital

Financial capital

Ultrapar recorded net revenues of R$ 119 billion in 2021, an increase of 46% compared to 2020, due to higher revenues in all its businesses, except Extrafarma, with the highlight being Ipiranga. The cost of goods sold and services provided at Ultrapar was R$ 112 billion in 2021, an increase of 48% compared to 2020, also due to higher costs in all businesses, except Extrafarma.

Ultrapar recorded a gross profit of R$ 7.1 billion in 2021, an increase of 26% in the annual comparison, due to the increase in the consolidated profit of all the businesses, especially Ipiranga, which had been the business most affected by the pandemic in 2020.

Ultrapar’s selling, marketing, general and administrative expenses increased 24%, due to the effects of inflation and the contingency expenses on several fronts throughout 2020, in addition to other specific effects across all businesses in 2021.

The other operating results line decreased 44% compared to 2020, mainly due to the lower provision for extraordinary tax credits at Oxiteno and the higher level of cost recognition related to Renovabio’s targets at Ipiranga, partially offset by (i) higher provision for extraordinary tax credits and higher merchandising revenues from suppliers at Ipiranga and (ii) receipt of insurance reimbursementfor business interruption losses from an incident at Oleoquímica (occurred in 2017) at Oxiteno in 2021

The disposal of property line increased 141% compared to 2020, due to the higher results from sales of real estate assets and the capital gain from the sale of ConectCar, both in Ipiranga.

In 2021, an effect of R$ 428 million was recorded in the line of impairment, because of the impairment of Extrafarma’s assets arising from the sale agreement of Extrafarma to Pague Menos.

Ultrapar’s recurring Adjusted EBITDA reached R$ 4.1 billion in 2021, an increase of 22% compared to 2020, mainly due to the increase in EBITDA at Oxiteno, Ipiranga and Ultracargo, partially offset by higher Holding expenses and lower EBITDA at Extrafarma. Ultragaz’s EBITDA remained stable.

The total expense for depreciation and amortization¹ in 2021 amounted to R$ 1.7 billion, an increase of 7% compared to 2020, due to the investments over the period.

Ultrapar posted an operating income of R$ 1.9 billion in 2021, a result 4% higher than 2020.

Ultrapar reported a net financial expense² of R$ 910 million in 2021, compared to R$ 269 million in 2020, mainly due to the negative effect of the mark-to-market of the hedges and a higher debt cost, because of higher interest rates.

Ultrapar’s net income reached R$ 884 million in 2021, a reduction of 5% compared to 2020, due to higher net financial expenses and higher depreciation, partially offset by higher EBITDA in the period and lower taxes.

2. Does not include the result of the cash flow hedge from bonds.

Ultra Group’s income statement

R$ million

| 2021 | 2020 | Variation 2021 X 2020 |

|

| Net revenues | 118,799 | 81,241 | 46% |

| (-) Cost of goods sold and services provided | (111,729) | (75,628) | 48% |

| (=) Gross profit | 7,069 | 5,613 | 26% |

| (-) Selling, marketing, general and administrative expenses | (5,062) | (4,098) | 24% |

| (-) Other operating results | 123 | 221 | -44% |

| (-) Gain on disposal of property, plant and equipment and intangibles | 183 | 76 | 141% |

| (-) Impairment | (428) | – | NA |

| (=) Operating income | 1,886 | 1,812 | 4% |

| (-) Financial result | (910) | (269) | 238% |

| (-) Share of profit of subsidiaries, joint ventures and associates | (18) | (44) | -60% |

| (=) Income before income and social contribution taxes | 959 | 1,499 | -36% |

| (-) Income and social contribution taxes | (75) | (571) | -87% |

| (=) Net income | 884 | 928 | -5% |

| (+) Income and social contribution taxes | 75 | 571 | -87% |

| (+) Financial result | 910 | 269 | 238% |

| (+) Depreciation and amortization | 1,377 | 1,267 | 9% |

| (=) CVM EBITDA | 3,246 | 3,036 | 7% |

| (+) Cash flow hedge from bonds | 176 | 154 | 15% |

| (+) Amortization of contractual asset with customers – exclusive rights (Ipiranga and Ultragaz) | 283 | 289 | -2% |

| (=) Adjusted EBITDA | 3,704 | 3,479 | 6% |

| (=) Recurring Adjusted EBITDA1 | 4,055 | 3,311 | 22% |

Capital Markets

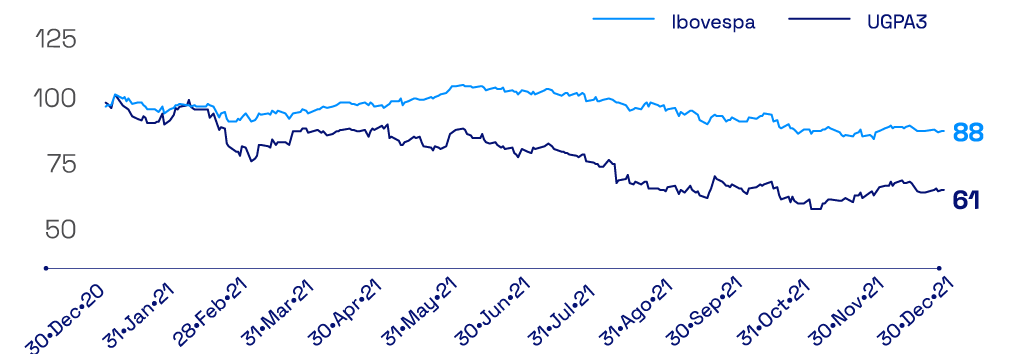

Ultrapar’s combined average daily financialvolume on the B3 and the NYSE totaled R$ 159 million/day in 2021 (-12%). Ultrapar’s share price ended 2021 quoted at R$ 14.54 on the B3, a depreciation of 39% in the year, while the Ibovespa stock in dex fell by 12%. On the NYSE, Ultrapar’s share price decreased 42% in the year, while the Dow Jones stock index appreciated 19%. Ultrapar ended 2021 with a market cap of R$ 16 billion.

Performance of UGPA3 x Ibovespa – 2021 (Dec 30, 2020 = 100)

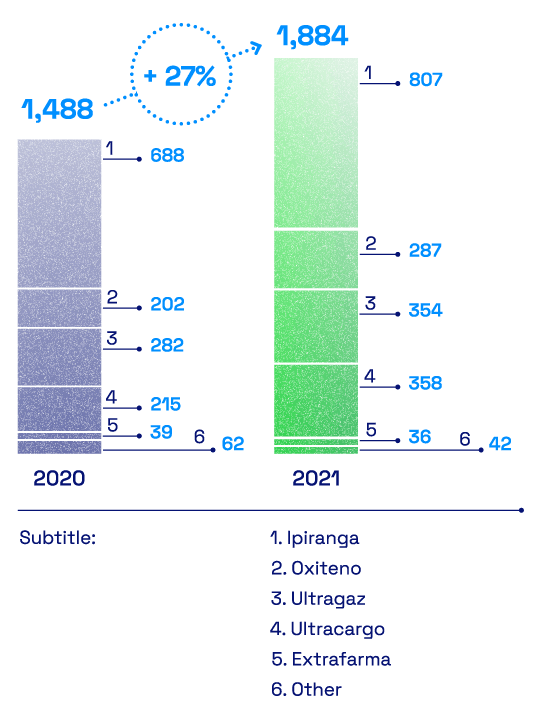

Investiments

In 2021, Ultrapar’s investments, net of divestments and receivables, totaled R$ 1.9 billion, 27% higher than for 2020, mainly due to lower investments in 2020 as a cash contingency measure, due to the uncertainties imposed by the pandemic and lower market growth.

Organic investments by business – R$ million