Energy Transition

Strategy and resources allocation | Prospects | Performance

Strategy and resources allocation | Prospects | Performance Manufactured capital

Manufactured capital Natural aapital

Natural aapital

Alignment to the SDGs

![]()

![]()

The Ultra Group operates in the distribution of fuels through Ipiranga, of LPG through Ultragaz and in the storage of fuels through Ultracargo. It is closely monitoring the deteriorating climate change scenario and the trends in making the decarbonization of the economy viable.

Today, the Group stores and distributes bio-fuels through Ultracargo and Ipiranga respectively. In 2021, Ipiranga accounted for 17.5% of Brazil’s total ethanol sales. The current infrastructure of both businesses has sufficient capacity to handle higher volumes of biodiesel and ethanol in the short term. Their medium and long-term strategic plans already consider the possibility of providing other solutions for low carbon energy.

In the search to migrate its operations increasingly towards products with a lower carbon footprint, Ultracargo, which is already handling ethanol and bio-diesel, is studying the viability of the storage and handling of transition fuels in strategic Brazilian ports.

In addition to distributing bio-fuels and marketing additives that improve engine performance and reduce pollutant emissions, Ipiranga is participating in some initiatives to respond to the trend to electric vehicles (EV) in the automotive sector. The most recent initiative involves the installation of more than 40 EV charging points in its service station network in the States of Rio Grande do Sul and São Paulo. The company has already installed EV charging points in 50 service stations. The six service stations along the Presidente Dutra Highway, between São Paulo (SP) and Rio de Janeiro (RJ), registered a 350% increase in the number of EV charges in 2021.

The Ultra Group is actively researching opportunities to enter the natural gas market, through Ultragaz. In addition, Ultragaz is studying new applications for LPG. The Group views both natural gas and LPG as transition fuels, which will complement the supply of intermittent renewable energy sources such as wind and solar.

In terms of capital allocation, the Group’s decisions on mergers and acquisitions already consider the risks and opportunities related to the transition of the Brazilian energy mix.

In-depth Discussions

As one of the Group’s material topics, in 2021, energy transition was the subject of in-depth discussions and analysis at all hierarchical levels, from the work-group dedicated to the topic, to the meetings of the Ultrapar Executive Board and the Board of Directors. Specialist consultants were hired to provide support for the discussions among senior management on the implications of energy transition for the Group’s strategic planning.

The Group also participated in external forums on the topic. Ipiranga participated in the Energy Transition Committee of the Brazilian Institute for Oil and Gas (IBP). In 2021, a carbon-pricing impact study for the sector was completed. In 2022, the IBP will prepare the first inventory of GHG emissions for the oil and gas sector, with the support of a specialized consultancy.

-

GROUP AMBITION

Plan and implement strategies aimed at the transition to a low carbon economy.

-

The CDP included the Ultra Group in its Brazil Climate Resilience Index (ICDPR70), in 2021

Regulatory and Tax Issues

The Ultra Group believes in Brazil’s potential to be a leading player in the transition to a low-carbon economy. It further believes that this can be achieved in an orderly and efficient manner, without affecting the supply of energy or negatively impacting the population, value chains and the country’s economic development. In the Group’s view, however, to achieve this it is necessary to change the regulatory and tax models of the fuel sector, which, in their current formats, inhibit investments in new technologies and infrastructure and restrict competitiveness in the sector.

The changes seen as necessary include a tax reform that provides incentives for the production and competitiveness of the various types of bio-fuel (second-generation ethanol, corn ethanol, bio-diesel and aviation bio-kerosene, among others) and the removal of market restrictions on the import of bio-fuels. Today, only fuel producers are allowed to import bio-fuels. An important advance already achieved concerns the new bio-diesel sales model, which came into force in January 2022. The model allows direct negotiation between distributors and producers, and replaces the previous public auctions arranged by the National Agency for Petroleum, Natural Gas and Bio-fuels (ANP).

The Carbon Disclosure Project (CDP)

Since 2008, the Ultra Group has responded to the Carbon Disclosure Project (CDP) Questionnaire, under its Disclosure.Insight.Action. Program. The questionnaire is designed to assess a company’s performance in the management of the topic of climate change. Furthermore, the questionnaire is aligned to the guidelines of the Task Force on Climate-related Financial Disclosure (TCFD).

In the 2021 questionnaire, the Group received a C score (awareness level). Changes in the CDP’s evaluation criteria and the Group’s stricter responses to the questionnaire resulted in an assessment that was lower the previous year, when it received a B score (management level), which is still within the average for South American companies. For more information see the CDP web site.

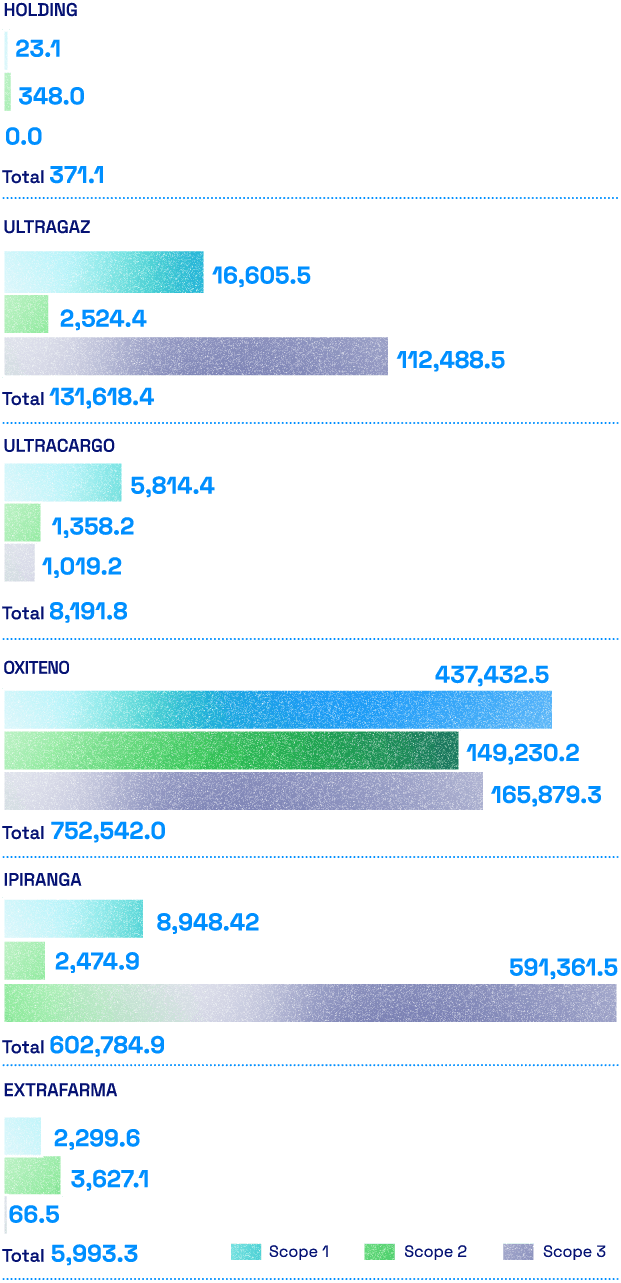

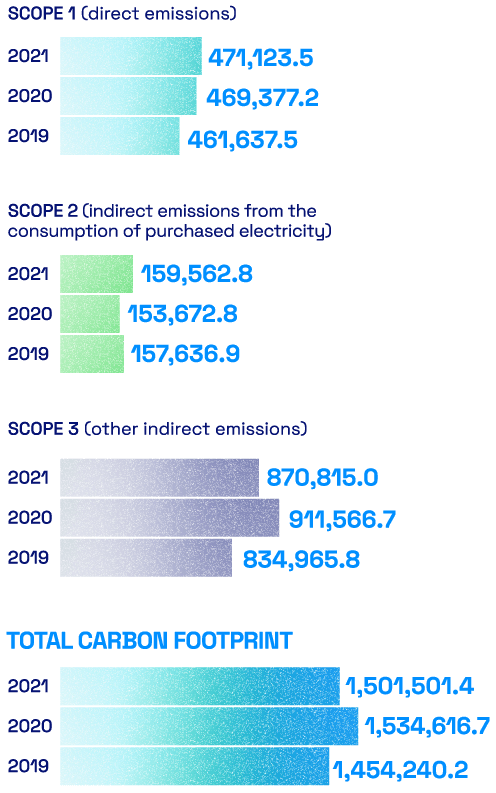

GHG Emission Performance

The Group’s total GHG emissions for the year reduced by 2% compared to 2020. For the first time the Group’s businesses acquired renewable energy certificates (I-RECS) enabling Ultragaz, Ultracargo and Ipiranga to completely offset their emissions from the consumption of purchased electricity. The Holding, which itself has a low carbon footprint, acquired the I-RECs in 2022, which will allow it to offset all GHG emissions linked to the consumption of purchased energy in 2021.

Ultragaz’s, direct GHG emissions (Scope 1) were 7% higher compared to 2020. The variation was due mainly to an increase in fuel consumption as a result of the expansion of the company-owned fleet of vehicles. Towards the end of the year, the company started to implement a route optimizing project to increase the efficiency of its deliveries to customers in the bulk liquids segment. The project was aimed at reducing the total mileage driven and, consequently, the Scope 1 GHG emissions.

Ultracargo’s direct GHG emissions were 45.7% lower compared to 2020. The volatile organic compounds (VOCs) burners at the Santos (SP) terminal are fed by LPG and are the company’s largest source of direct GHG emissions. They cannot be replaced due to the legal conditions imposed by the environmental license to operate. The volume of fuels handled at the terminal decreased by around 60% in 2021, which reduced the need to use its VOC burners during the year. Furthermore, in the last quarter, one of the burners was shut down due to a technical fault, also reducing LPG consumption. The company informed the environmental authorities and redirected the flows to another burner.

Oxiteno’s direct emissions direct emissions were practically the same as for the previous year (increase of 1.6%). Oxiteno´s continues to use waste gases from partners for the generation of steam in its boilers. Currently, these waste gases represent 8% of the company’s energy mix. It also sells the gases produced in the manufacture of ethylene oxide, which can be used as raw materials in other production processes. In 2021, 40,792 tons of CO2 were sold to White Martins in Camaçari and 7,291 tons of CO2 to Air Liquide in Mauá (SP).

Ipiranga’s total carbon footprint decreased by 3% compared to 2020. Scope 1 emissions increased by 1% and Scope 3 emissions reduced by 4% compared to the previous year. The significant growth in its Scope 2 emissions was due to variations in the GHG emission factor for the National Interconnected System of electricity (SIN).

Extrafarma reduced its direct emissions by 56.9% due to a lower consumption of fossil fuels in its generators, and in its company-owned fleet of vehicles, as a result of implementing a route optimization project in 2021. The company’s Scope 2 emissions were stable and its reported Scope 3 emissions reduced by 26%, mainly due to the lower number of corporate trips. Extrafarma outsourced part of its distribution of products, but the associated emissions were not considered in the calculation of Scope 3 emissions since they are not monitored.

Technology as an Enabler

In recent years, the Ultra Group has intensified its investments in research and innovation, which are essential to enabling the acceleration of the rate of energy transition. Ultragaz has allocated R$ 21.6 million for the development of innovations in the uses of LPG in 2021. The focus is to find solutions that enable the replacement of more polluting energy sources by LPG, and that prioritize the most efficient consumption of the product, contributing to the reduction of the customer’s carbon footprint.

Businessmen for the Climate

Aware that the transition to a low carbon economy depends on the collective efforts of governments and private organizations from the most diverse sectors, the Ultra Group signed the letter entitled “Businessmen for the Climate”, which was launched in September by the Brazilian Business Council for Sustainable Development (CEBDS).

The letter defended the definition of ambitious climate goals and a high-profile role for Brazil in the global climate change agenda. It was published shortly before the 26th United Nations Conference of the Parts on Climate Change (COP26).

Total GHG Emissions 2021 – By Business (tCO2e)

Ipiranga Zero Carbon

Ipiranga has offset all its direct emissions (Scope 1) and indirect emissions from purchased electricity consumption (Scope 2) since 2014. The company also provides options for consumers to neutralize their own carbon footprints.

This initiative is part of the Ipiranga Zero Carbon Program, which also includes monitoring and emission reduction measures.

ESG Dashboard

Total GHG Emissions – Ultra Group (tCO2e)

Emission intensity of the Business in 2021 (scopes 1 e 2)

| Business | Emission Intensity | Variation 2021 vs. 2020 |

| Holding | 0.81 tCO2e/employee | + 11.4% |

| Ultragaz | 0.0111 tCO2e/t of LPG sold | + 15.6% |

| Ultracargo | 0.0011 tCO2e/t of product handled | – 78.4% |

| Oxiteno | 0.4400 tCO2e/t of product produced | + 2.3% |

| Ipiranga | 0.0006 tCO2e/t of product sold | sem variação |

| Extrafarma | 0.0028 tCO2e/sales (R$ thousand) | – 65% |